Understanding the Best Free Money App

Are you looking for a way to manage your finances more effectively? Do you want to find an app that can help you save money without any additional costs? If so, you might want to consider using the best free money app available. In this article, we will delve into the details of this app, exploring its features, benefits, and how it can help you take control of your finances.

What is the Best Free Money App?

The best free money app is an app designed to help users manage their finances, save money, and invest in a variety of ways. This app is free to download and use, making it an excellent choice for those who want to improve their financial health without spending a dime.

Features of the Best Free Money App

The best free money app offers a range of features that can help you manage your finances more effectively. Here are some of the key features:

-

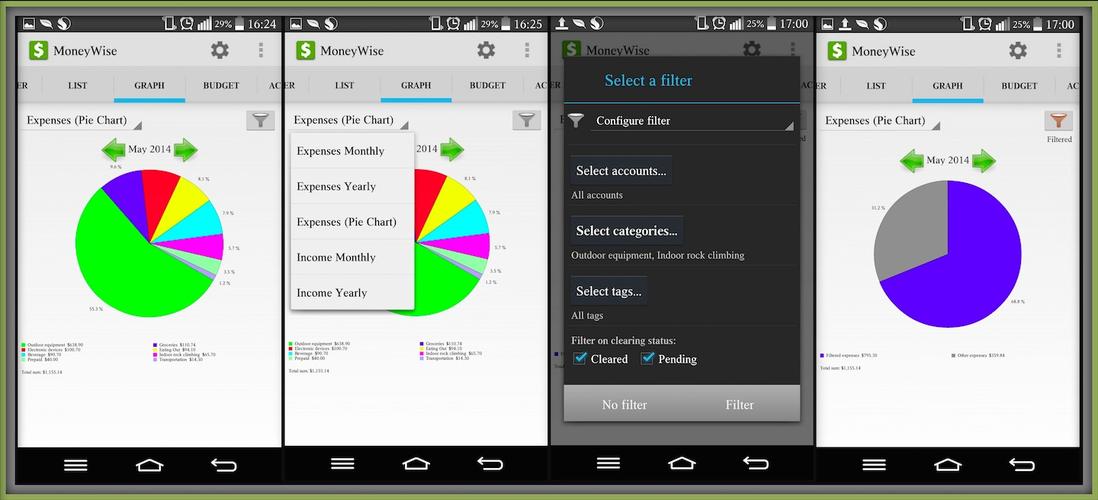

Expense Tracking: The app allows you to track your expenses in real-time, helping you stay on top of your spending and identify areas where you can cut back.

-

Goal Setting: You can set financial goals within the app, such as saving for a vacation or paying off debt, and track your progress towards these goals.

-

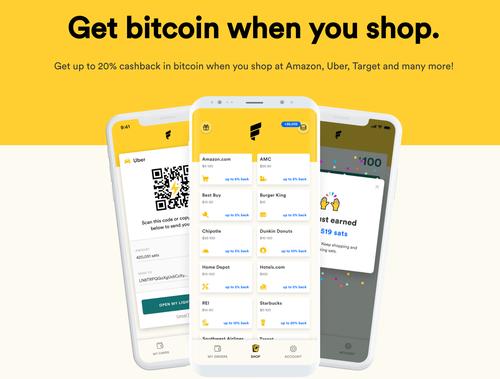

Investment Opportunities: The app offers a variety of investment opportunities, allowing you to grow your money over time.

-

Debt Management: The app can help you manage your debt by providing you with tools to create a repayment plan and track your progress.

-

Personalized Recommendations: The app uses your financial data to provide personalized recommendations on how to improve your financial health.

Benefits of Using the Best Free Money App

Using the best free money app can offer a range of benefits, including:

-

Increased Financial Awareness: By tracking your expenses and setting financial goals, you can become more aware of your spending habits and make more informed financial decisions.

-

Debt Reduction: The app’s debt management tools can help you pay off debt faster, saving you money on interest and improving your credit score.

-

Investment Growth: The app’s investment opportunities can help you grow your money over time, providing you with a source of passive income.

-

Time Savings: By automating many of the financial tasks, the app can save you time, allowing you to focus on other aspects of your life.

How to Get Started with the Best Free Money App

Getting started with the best free money app is simple. Here’s a step-by-step guide:

-

Download the App: Visit the app store on your smartphone or tablet and download the best free money app.

-

Sign Up: Create an account by entering your email address and password.

-

Link Your Accounts: Connect your bank accounts, credit cards, and other financial accounts to the app to track your expenses and investments.

-

Set Your Goals: Create financial goals within the app and start tracking your progress.

-

Explore Investment Opportunities: Take advantage of the app’s investment opportunities to grow your money.

Table: Comparison of the Best Free Money App with Other Apps

Below is a table comparing the best free money app with other popular financial apps:

| App | Expense Tracking | Goal Setting | Investment Opportunities | Debt Management |

|---|---|---|---|---|

| Best Free Money App | Yes | Yes | Yes | Yes |

| App A | Yes | No | No | No |

| App B | No | Yes | No | No |