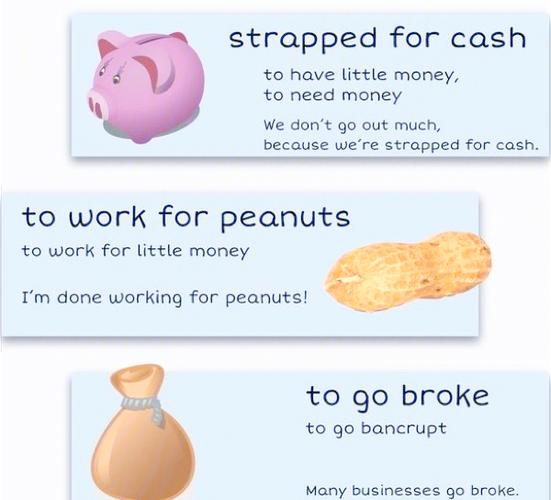

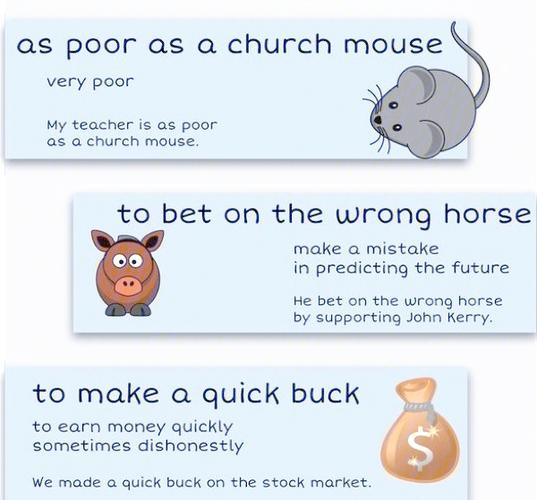

Understanding the Concept of ‘Earn a Quick Buck’

Have you ever heard the phrase “earn a quick buck”? It’s a term that’s often used to describe the desire to make money quickly, often through less-than-ethical means. In this article, we’ll delve into what it means to earn a quick buck, the risks involved, and how you can avoid falling into the trap of seeking instant wealth.

The phrase “earn a quick buck” is often associated with get-rich-quick schemes, high-risk investments, and other speculative ventures. While the allure of making money fast is strong, it’s important to understand the potential consequences before diving in. Let’s explore the various aspects of earning a quick buck.

What Does It Mean to Earn a Quick Buck?

At its core, earning a quick buck refers to the pursuit of immediate financial gain, often without considering the long-term implications. This could involve participating in high-risk investments, engaging in fraudulent activities, or taking shortcuts in business ventures. While the idea of making money quickly is enticing, it’s crucial to recognize that such endeavors often come with a high degree of risk and uncertainty.

Risks Associated with Earning a Quick Buck

There are several risks associated with trying to earn a quick buck. Here are some of the most common:

| Risk | Description |

|---|---|

| Financial Loss | Investing in high-risk ventures can lead to significant financial losses, especially if the market takes a downturn. |

| Legal Consequences | Engaging in fraudulent activities can result in legal repercussions, including fines and imprisonment. |

| Reputation Damage | Participating in unethical practices can damage your reputation, making it difficult to secure future business opportunities. |

| Emotional Stress | The pressure to make money quickly can lead to increased stress and anxiety, negatively impacting your mental health. |

How to Avoid the Trap of Earning a Quick Buck

If you’re looking to make money, it’s important to focus on sustainable and ethical methods. Here are some tips to help you avoid the trap of seeking instant wealth:

-

Develop a long-term plan: Instead of focusing on quick gains, create a plan that outlines your financial goals and the steps you’ll take to achieve them.

-

Invest in yourself: Invest in your education, skills, and health to improve your chances of earning a steady income.

-

Research thoroughly: Before investing in any venture, do your homework to understand the risks and potential returns.

-

Stay patient: Wealth accumulation takes time, and trying to rush the process can lead to poor decisions.

-

Seek professional advice: Consult with financial advisors or experts to help guide you in making informed decisions.

Conclusion

While the allure of earning a quick buck is strong, it’s important to recognize the risks involved and focus on sustainable and ethical methods of making money. By developing a long-term plan, investing in yourself, and seeking professional advice, you can increase your chances of achieving financial success without falling into the trap of seeking instant wealth.