Understanding Free Cash Flow

Are you looking to earn free cash now? If so, you’ve come to the right place. Free cash flow, often abbreviated as FCF, is a crucial financial metric that can help you understand the financial health and potential of a business. In this article, we’ll delve into what free cash flow is, how it’s calculated, and why it’s important for both businesses and investors.

What is Free Cash Flow?

Free cash flow is the cash that a company generates after it has paid for all its operating expenses, capital expenditures, and taxes. It represents the cash that is available to the company’s investors and creditors after all necessary business operations have been funded. In simpler terms, it’s the cash that a company has left over after it’s paid for everything it needs to run its business.

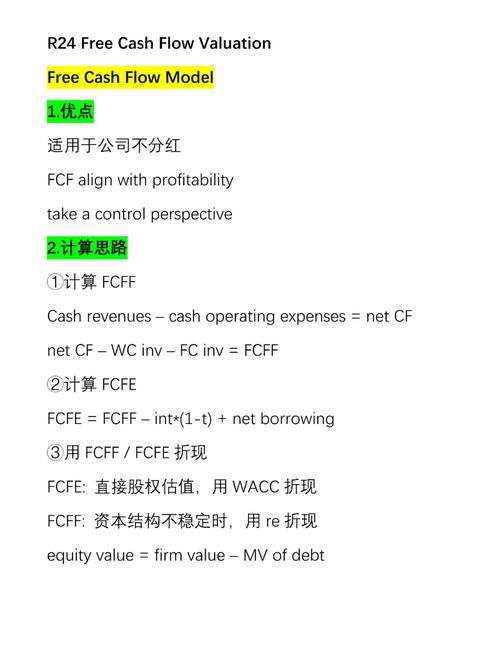

Calculating Free Cash Flow

Calculating free cash flow is relatively straightforward. The formula is as follows:

| Operating Cash Flow | Less: Capital Expenditures | Equals: Free Cash Flow |

|---|---|---|

| Net income + Depreciation + Amortization | Investment in property, plant, and equipment |

Here’s a breakdown of each component:

- Operating Cash Flow: This is the cash generated from the company’s core operations. It’s calculated by adding back non-cash expenses like depreciation and amortization to net income.

- Capital Expenditures: These are the investments a company makes in its assets, such as property, plant, and equipment. They are subtracted from operating cash flow because they represent cash outflows.

- Free Cash Flow: This is the cash left over after the company has paid for its operating expenses and capital expenditures.

Why is Free Cash Flow Important?

Free cash flow is important for several reasons:

- Investment Opportunities: A company with positive free cash flow has the cash to invest in new projects, expand its operations, or acquire other businesses.

- Debt Reduction: Free cash flow can be used to pay down debt, which can improve the company’s financial stability and reduce its interest expenses.

- Dividends and Stock Repurchases: Companies can use free cash flow to pay dividends to shareholders or to repurchase their own stock, which can increase the value of the company’s shares.

- Financial Health: Positive free cash flow is a sign of a healthy business that can generate cash to fund its operations and growth.

Free Cash Flow and Valuation

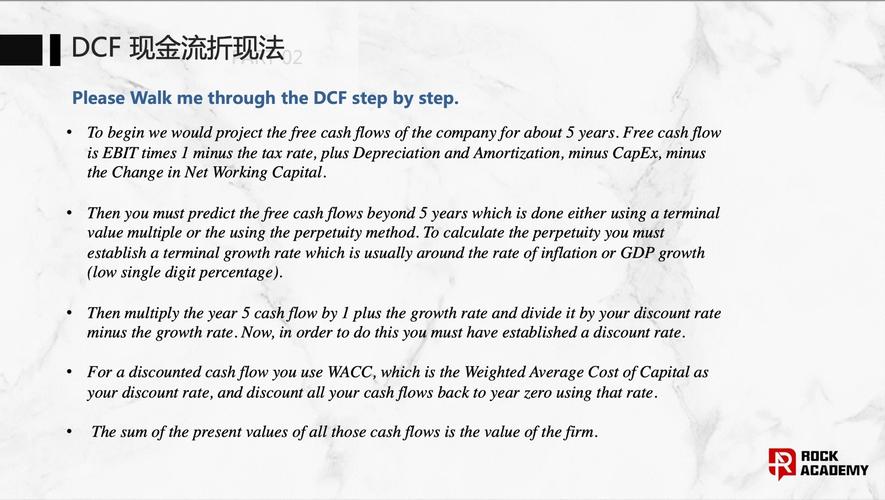

Free cash flow is also an important metric for valuing a company. Investors often use a discounted cash flow (DCF) analysis to estimate the value of a company’s shares. In a DCF analysis, the expected future free cash flows of the company are discounted back to their present value using a discount rate. The sum of these present values is then used to estimate the company’s intrinsic value.

Free Cash Flow and Risk

It’s important to note that free cash flow is not a perfect measure of a company’s financial health. A company can have positive free cash flow but still be at risk of defaulting on its debt or running into financial trouble. For example, a company may be generating a lot of free cash flow but using it to fund a high level of debt, which can increase its risk of financial distress.

Conclusion

Earning free cash flow is a key goal for any business. By understanding what free cash flow is, how it’s calculated, and why it’s important, you can better assess the financial health and potential of a business. Whether you’re an investor or a business owner, free cash flow is a valuable metric to keep an eye on.