Apps for Pay: A Comprehensive Guide

Are you looking to streamline your payment process? Apps for pay have revolutionized the way we handle transactions, offering convenience, security, and a wide range of features. In this detailed guide, we will explore the ins and outs of apps for pay, covering everything from their benefits to the best options available.

Understanding Apps for Pay

Apps for pay, also known as mobile payment apps, allow users to make transactions using their smartphones. These apps utilize near-field communication (NFC) technology, allowing users to simply tap their devices on compatible payment terminals. Let’s delve into the key aspects of these apps.

| Feature | Description |

|---|---|

| Convenience | Apps for pay eliminate the need for cash or cards, allowing users to make payments quickly and easily. |

| Security | These apps often use encryption and tokenization to protect sensitive information, reducing the risk of fraud. |

| Accessibility | Users can make payments from anywhere, as long as they have their smartphone and a compatible payment terminal. |

Benefits of Using Apps for Pay

Apps for pay offer numerous benefits, making them a popular choice for both consumers and businesses. Let’s explore some of the key advantages.

1. Time-saving

One of the most significant benefits of apps for pay is the time-saving aspect. With these apps, users can make payments in seconds, eliminating the need to search for cash or cards and wait in long lines.

2. Enhanced security

Security is a top priority for apps for pay. These apps use advanced encryption and tokenization techniques to protect sensitive information, such as credit card numbers and personal details. This reduces the risk of fraud and unauthorized access.

3. Increased convenience

Apps for pay provide users with the convenience of making payments from anywhere, at any time. Whether you’re shopping online or dining out, these apps make it easy to complete transactions without the need for physical cash or cards.

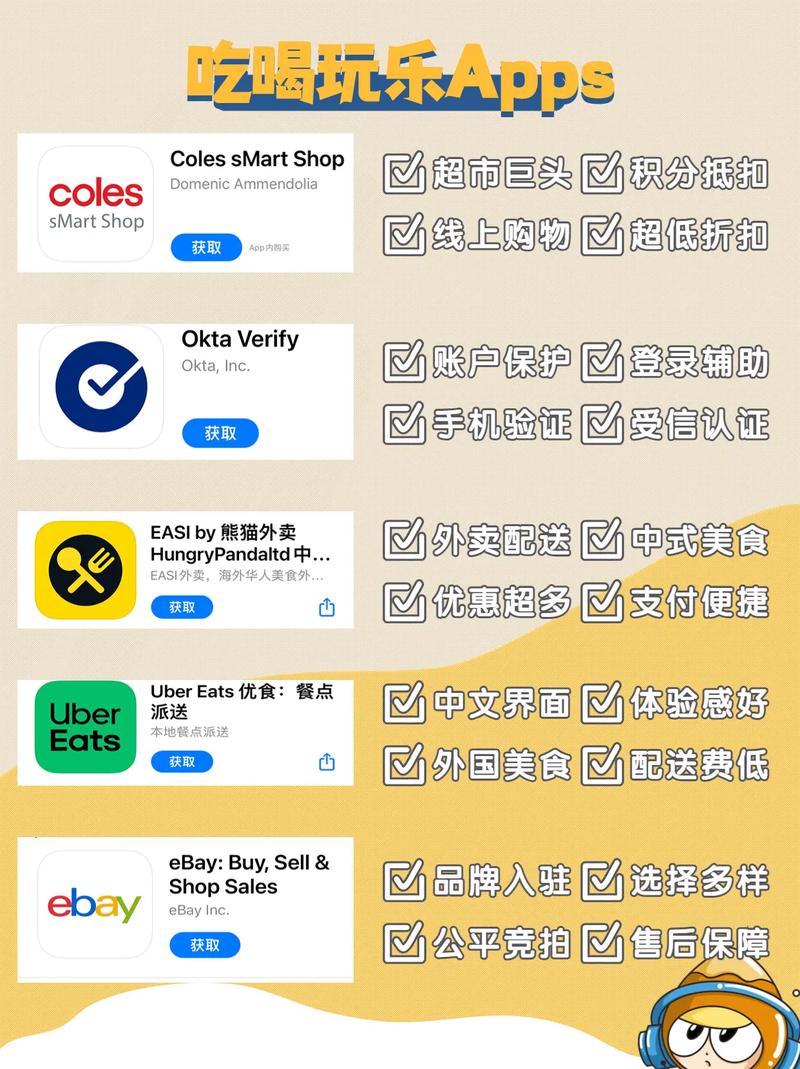

Top Apps for Pay

With numerous apps for pay available, it can be challenging to determine which one is the best for your needs. Here’s a look at some of the top options on the market.

1. Apple Pay

Apple Pay is a popular app for pay that works with iPhone, iPad, and Apple Watch. It offers a seamless payment experience, allowing users to make purchases with a simple tap of their device.

2. Google Pay

Google Pay is another widely used app for pay, compatible with a variety of devices and operating systems. It offers a user-friendly interface and supports a wide range of payment methods, including credit cards, debit cards, and bank accounts.

3. Samsung Pay

Samsung Pay is specifically designed for Samsung devices and offers a secure and convenient payment experience. It supports both NFC and magnetic secure transmission (MST) technology, allowing users to make payments at a wide range of merchants.

How to Get Started with Apps for Pay

Getting started with apps for pay is a straightforward process. Here’s a step-by-step guide to help you get up and running.

- Download the app of your choice from the app store on your smartphone.

- Open the app and follow the on-screen instructions to set up an account.

- Link your payment method(s) to the app, such as credit cards, debit cards, or bank accounts.

- Activate the app by adding a payment method and verifying your identity.

- Start making payments using your smartphone at compatible merchants.

Conclusion

Apps for pay have transformed the way we handle transactions, offering convenience, security, and a wide range of features. By understanding the benefits and top options available, you can make an informed decision on which app for pay is best suited for your needs. So, why not give it a try and experience the convenience of apps for pay today?